Bitcoin 101: past, present and future

Table of Contents

In this article I will talk about the most important facts related to Bitcoin, the current state of the protocol and possible future developments. If you want to learn more about these topics, you can listen to the podcast Il Priorato del Bitcoin, with Giacomo Zucco as host.

The priory is benevolent.

Support me! If you would like to support my work, you can visit the donations page, where you will also find references from people I value in the community. Every contribution, however large or small, helps me to spend more time writing, revising and updating these articles. Thank you for your support.

Step by step #

Bitcoin was not born in 2008. In fact, it is the result of decades of study and research in the field of computing. To best understand the origins of Bitcoin, we have to go back in time to 1933. Its prehistory is full of important events and to understand where we are today, we have to take a not inconsiderable time plunge.

From 1930 to 1940 #

In 1933, Franklin Delano Roosevelt signed Executive Order 6102 that prohibited the private use of money in direct form, such as doubloons and coins, or in indirect form, such as banknotes representing collateral, such as gold. At the time, inflation in America was heavy, the federal public coffers were collapsing, and the economic situation was difficult. Consequently, the government confiscated all the gold of private citizens. This event is important to understand the history of bitcoin, as we are talking about the land of the free, the home of constitutional liberal democracy, not North Korea.

Jumping forward in time, in 1936, a young Alan Turing published a paper entitled On Computable Numbers, with an Application to the Entscheidungsproblem, which formed the theoretical basis for the practical digital revolution and of course Bitcoin could never have come into being without the digital revolution. Shortly afterwards, in 1938, the first computer working with electromagnetic pulses, called torpedo data computer, was built on top of a submarine. Although it could only perform trigonometric calculations, it was not a all-purpose computer like the ones we are used to today. In 1939, the first digital computer was born, called Z2, built by a German engineer, although there is some controversy as to the actual authorship of this calculator.

From 1970 to 1980 #

In 1971 a very serious event happened, known as the Nixon Shock. Because of the war in Vietnam and the general recession, the US federal government needed money and President Richard Nixon decided to suspend the convertibility of the dollar into gold.

Until then, the entire world economic system was based on the following scheme: all official state currencies were convertible into US dollars and each country’s central bank promised the convertibility of its local currency into US dollars, while the US central bank promised the convertibility of these dollars into gold.

Nixon, claiming to want to protect the dollar from speculators, announced on live television that the convertibility of the dollar into gold would be temporarily suspended. It is now 2022 but Nixon’s suspension is still in full force.

From economics we return once again to technology. In 1974, Cerf and Kahn published a study entitled A Protocol for Packet Network Intercommunication, a protocol that allowed different computer networks to be connected together, known today as IP (Internet Protocol).

In 1976, researchers Diffie and Hellman published the paper New directions in cryptography.

Until then, encryption used a symmetric key, which worked (for example) as follows:

- Alice has a plaintext that she wants to encrypt and send to Bob;

- Alice “moves forward” each letter of the text by seven positions, resulting in a block of text with no logical meaning;

- Alice sends Bob the encrypted text;

- To recover the original text, Bob must “move back” each letter of the block of text received from Alice by seven positions.

All cryptographic systems until 1976 were of this type and were insecure because they were based on the concept that one can ’turn a key one way’ and ’turn it the other way’ very easily.

In “New directions in cryptography” (asymmetric cryptography) theorised by Diffie and Hellman, it is still very easy to turn a key one way', but virtually impossible to turn the key the other way'.

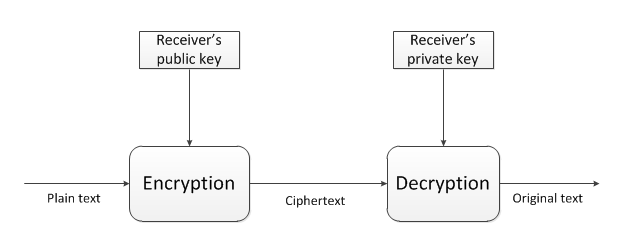

Example of asymmetric encryption:

- Each party in a cryptographic exchange has two keys, a public and a private key;

- Alice generates a private key;

- Alice mathematically and deterministically calculates the public key associated with the private key;

- Alice can send her public key to anyone;

- Bob, who wants to communicate encrypted with Alice, will use Alice’s public key to make a text unreadable;

- The content of the text can only be decrypted by Alice’s private key.

Two years later, in 1978, Rivest, Shamir and Adleman published a study entitled A Method for Obtaining Digital Signatures and Public-Key Cryptosystems. These three authors developed an algorithm that effectively made the asymmetric key cryptography introduced in 1976 possible, based on the use of prime numbers.

Prime numbers have an important characteristic: if I asked you to multiply the number 3 by the number 5, it would be very simple; but if I asked you for the prime factors of a prime number like 15, this operation is generally more complex. You would probably think it obvious that the prime factors of 15 are 3 and 5, but if you were to move this argument to very large numbers, it would be impossible to determine the solution, since there is no simple algorithm for solving this kind of problem.

The same year, a very influential book by a Nobel Prize winner in economics came out, entitled Denationalisation of Money by F.A. Hayek, an exponent of the Austrian school of economics. Hayek was very much against the state monopoly on money, which in his opinion `has never existed in the history of mankind’. According to Hayek, total monopoly is destructive and the idea he proposed was that money should go back to being issued (and chosen) by market actors, without any form of centralisation that could generate corruption and systemic crises.

In a way, Hayek predicted the immaculate conception of Bitcoin. 😁

In 1979, a mathematician named Claus P. Schnorr patented the idea of the merkle tree. To simplify, the basic idea of the merkle tree is to have a structure used to verify the integrity of a data set. It works by dividing the data into small parts, then creating pairs of these parts and calculating the hash (a unique, unpredictable and non-reversible value) of each pair. This process is repeated until all the parts have been included in a single root, called the merkle root, which summarises all the parts.

When you want to check the integrity of a data set, simply calculate the hash of each part and check that it is the same as the one found in the merkle tree. If the hash of a part is different, it means that the data has been modified or altered in some way. The merkle tree by the way is very efficient because it requires little disk space and allows the integrity of the data to be verified even when it is divided into small parts and distributed over a network.

From 1980 to 1990 #

In 1980, Samuel Konkin III published the New Libertarian Manifesto, in which he advocated agorist thinking, i.e. the idea that:

It is not enough to proclaim the beauty of freedom and the ugliness of the state, but we must act pragmatically and build technical instruments capable of defeating the state.

– Samuel Konkin III

This thought would later be adopted by the chyperpunks movement.

In 1981, two significant events occurred:

- The Internet Protocol reached version 4, and it is fascinating to think that in 2022 this obsolete version is still being used (for example to read this site), despite the fact that the Internet has become the backbone of the modern world;

- Mr. David Chaum imagined an untraceable electronic mail protocol using digital pseudonyms and published the paper Untraceable electronic mail, return addresses, and digital pseudonyms. This publication is very important because it marks the beginning of the use of the concept of asymmetric cryptography to sign messages instead of encrypting texts.

To better understand the difference from the asymmetric encryption example above, let us look at this example:

- Alice sends a message to Bob and wants to prove that she is the owner of the message;

- Alice signs the message with her private key;

- Alice sends Bob the plaintext and the encrypted text with her private key;

- Bob knows Alice’s public key, so he can decrypt the text with Alice’s public key;

- If Alice actually signed the message with her private key, then the plaintext and the encrypted text (decrypted by Bob) will be identical.

Alice then certified the communication by proving that she had signed with her private key 🎉

From 1982 to 1988 there were several key steps:

- In 1982 there is no real key passage but it is indicative of a general culture that was spreading: the paper The Ethics of Liberty is published in which Murray N. Rothbard (another Austrian economist) suggests the abolition of the US Federal Reserve and a return to market money;

- In 1983, David Chaum published the paper Blind signatures for untraceable payments and for the first time the idea of using a cryptographic signature system to make untraceable digital payments was introduced;

- Two years later, in 1985, Koblitz published Elliptic curve cryptography proposing an alternative way to RSA to make public key signatures based on finite-field eliptic curves.

- Finally, 1988 saw the appearance of the Crypto Anarchist Manifesto by Timothy May, an anarchist agorist like Konkin III. In brutal summary Timothy states:

In the physical world the state controls us, but in the digital world, of the Internet, thanks to cryptography, the state will not be able to control us if we develop the right tools. We could create pseudonyms by exchanging ideas, services and products without necessarily having to be monitored.

– Timothy May

In 1989, David Chaum, developed an electronic payment system (with patent) based on asymmetric cryptography and blind signatures, called DigiCash.

The idea behind DigiCash was to provide an electronic means of payment that was secure, anonymous and guaranteed users’ privacy. To achieve this, Chaum used cryptography to protect transactions and to ensure that only the sender and the recipient could see the transaction details, all bundled with a system of ‘digital signatures’ to verify the authenticity of transactions and to prevent forgery.

DigiCash’s system was based on the digital currency ecash, which could be transmitted over the network and used to make online payments. Users could purchase ecash from banks or other financial institutions and use it to make payments quickly and securely.

From 1990 to 2000 #

In 1990, Claus Schnorr patented a type of signature using elliptic curve cryptography, which proved to be very effective and possessed certain features such as formal security demonstrability and aggregability of signatures. If Alice and Bob signed a text with their private keys and then summed their signatures, the result was a valid public key signature that was the sum of Alice and Bob’s public keys. Headaches? All in the norm, these technicalities have been important for the recent development of Bitcoin (such as taproot) and we will examine them later.

In 1991, two important events occurred:

- Phil Zimmermann invented PGP (Pretty Good Privacy), which basically works by creating a public key and a private key for each user. The public key is used to encrypt messages or documents that are sent to the user, while the private key is used to decrypt messages or documents that are received by the user. In this way, only the user can read the messages or documents he receives, since he alone has the private key to decrypt them;

- Researchers Haner and Stornetta published the paper How to time-stamp a Digital Document, also cited by Satoshi Nakamoto in his paper on Bitcoin. In this paper, the two researchers discovered how to prove the existence of a document at a given instant in time, but Bitcoin had to do a bit more: prove, in the same interval, both

existenceanduniqueness.

In 1992, the chyperpunks were born in San Francisco, libertarian activists who advocated the intensive use of computer cryptography as part of a path of social and political change, for instance by hacking confidential archives to make public certain inconvenient truths.

In the following two years, 1993 and 1994, the following were published respectively:

- A chyperpunk’s Manifesto: the difference cyhperpunks and cryptoanarchists is that the latter advocate the use of cryptographic technology as a means to promote anarchy and individualism in society while chyperpunks are activists who use cryptography to change society and politics;

- The chypernomicon by Timothy May which in some ways is prophetic as it examines how cryptographic technology can be used to protect the privacy of personal data, to create a network for the exchange of goods and services without the control of government institutions, and to protect freedom of speech and expression in an increasingly interconnected world.

Still in 1994, an alternative version of Chaum’s DigiCash called CyberCash was created by Daniel C. Lynch.

Two years later, in 1996, lawyer Barry Downey and oncologist Douglas Jackson founded e-gold in California, because they argued that given the inconvertibility of the US dollar in gold and the lack of limits on the central bank’s printing of money, the state monetary system would be doomed to implode. However, gold was unsuitable for an internet age, so they decided to create a company that would use gold as collateral (subject to strict audits) and someone would pay with e-gold, they would write a digital cheque (using a system very similar to Chaum’s DigiCash) that could be sent to others via email addresses. This idea made it possible to exchange digital securities representing grams of gold.

During the same period, the US NSA also published a paper on how to create an online currency similar to DigiCash/CyberCash, although the actual purposes of this publication are not known.

Three important events took place in 1997:

- Adam Back created HashCash to solve the following problem: Adam Back, being a chyperpunk, talked to other people via (anonymous) e-mail and these were disposable. This created a problem, that of spam. To avoid spam, Adam used a very creative method. I explain with an example:

- Alice creates the e-mail message:

Hello, how are you?with today’s date and then hashes the message; - Alice sends Bob the text and the hash;

- Bob decides that if the message hash starts with

0he will read the message, otherwise he will not read it; - If Alice notices that the hash of her email starts with

1, she doesn’t send the message, and will edit the text slightly to create a new hash: if it comes out0she’ll send it (and Bob will read it), otherwise she’ll have to try again. - And so on.

If Bob notices that he is still receiving too much spam, he can change the difficulty by dictating that he will only read emails if the message hash starts with 00 instead of 0. I only point out that in this way the difficulty does not double, it increases quadratically.

It’s exactly proof-of-work of Bitcoin! 👌

There had already been a similar idea with the ‘92 paper Pricing via Processing or Combatting Junk Mail.

To conclude 1997, two other significant events occurred:

- The computer scientist (and chyperpunk) Nick Szabo publishes a text that talks for the first time about

smart contracts(this proves that smart contracts are not the invention of some recent shitcoiner). What Nick states in the paper Formalising and Securing Relationships on Public Networks is that not only is it possible to send cash from one public key to another as David Chaum does in DigiCash, but the problem can be generalised and stated that it is possible to use cryptography to secure online communications and transactions, thus protecting sensitive information and digital assets. Szabo mentions smart contracts, automated programmes that perform specific actions according to predefined conditions, to formalise relationships on the network and ensure their security, e.g. by implementing time or multi-signature tests; - The book The Sovereign Individual is published, which is also very prophetic and which we can summarise for simplicity with:

The world of sovereign states is coming to an end because the Internet will bring the possibility of choosing where to live, the sovereign individual will be able to go around with different nationalities, different residences, different passports. In doing so, the individual will be able to shop for the best state, the state will no longer be his ruler but will be his service provider.

After the very hot year of 1997 we come to 1998, which is even hotter because Nick Szabo invents a potentially decentralised version of DigiCash, called BitGold. He describes it in 1998 but does not publish it until 2005 in a complete and formal manner. It can be said that he is very close to the idea of Bitcoin even though there is still a fundamental piece missing.

Meanwhile, a very famous chyperpunk called Wei Dai publishes a paper creating B-Money without presenting any code but proposing the use of a system of smart contracts to manage transactions and ensure the security of the system. The smart contracts would have acted as automatic intermediaries for transactions, verifying that the conditions for their execution were met before executing the transactions. In this way, the system would have been able to function without the need for a central control body. There is, however, one problem that plagues both Nick Szabo and Wei Dai and that is that of double spending.

To this excellent question, Wei Dai proposes to establish an order for transactions and to do this, one votes to determine which transaction arrived first and which arrived later. However, there is a risk that some fake nodes will vote to make it appear that a transaction arrived earlier or later than it really is. Also, not all nodes in the network have the same voting power. Some may vote with more weight because they have placed digital money as collateral, and the weight of their vote depends on how much money they have placed as collateral (stake).

After various analyses, we come to the conclusion that it cannot work because it is a circular mechanism and to achieve this system the weight of the vote that decides which transaction came first is defined by the possession of the money in stake and the possession of the money in stake depends on previous transactions and their technology which in turn depends on a vote that depends on possession and so on. An endless loop. This logical circularity results in a weak system, which easily leads to attacks and centralisation.

Other important events in 1998:

- Bernard von NotHaus creates the Liberty dollar, a digital currency based on gold and silver. The Liberty Dollar system provided for the issuance of physical and digital gold and silver coins, as well as credit cards and cheques that could be exchanged as currency. The currency was based on an exchange rate set by the gold and silver market and could be used as an alternative to traditional currencies such as the US dollar. In 2009, the US federal state prosecuted him by sending him to jail, making it clear that there could be no competition in the liberal homeland;

- Peter Thiel creates Coinfinity, an online payment system for e-commerce, but the way he envisions it is something similar to Bitcoin:

In the physical world you will interact with the currency of your state, but when you are on the internet you are a citizen of cyber space and therefore without borders, boundaries and bureaucracy you will pay in the coinfinity currency – Peter Thiel

In 1999, dear Elon Musk entered the game and created X.com, a payment system with the same basic idea as Peter Thiel’s Coinfinity, and the same year, Milton Freeman delighted us with a prophecy:

I think the Internet will be a huge force in reducing the power of government in people’s lives. But there is one thing that is missing –and will soon be invented– and that will be a digital Internet currency in which A can transfer funds to B without B knowing A. This system does not yet exist, but it will exist and it will make the Internet the ultimate revolution. – Milton Freeman

From 2000 to 2007 #

In 2000, there was the merger of Elon Musk’s X.com and Peter Thiel’s Coinfinity, which gave rise to PayPal. As always, the regulator arrived, categorically forbidding the development of the PayPal ideal, because there must be no competition with the US dollar. After a few visits from central bankers and the federal government, PayPal abandoned its ideal of an Internet currency, but became a payment network for traditional currencies (above licensed banks, with all that that entails: bureaucracy, censorship, inflation.

In 2001 we have three important events:

- Bram Cohen created BitTorrent, a peer-to-peer protocol with open-source software at its base, impossible to stop due to its decentralised nature. In 2001, Napster already existed to exchange music, films and digital files in general, but it worked in a centralised manner.

With BitTorrent, the fight against pirated music became virtually lost.

-

After the collapse of the Twin Towers on 11 September, the strictest financial regulation in the history of mankind (under the pretext of terrorism) with many sanctions and preventive surveillance was born. It was decided that politicians and bureaucrats of the federal government should know every movement and reason for the movement of funds of every human being, inside and outside the American jurisdiction. Regulations KYC and AML were introduced everywhere.

-

In an e-mail exchange between 16-year-old Peter Todd and the famous Adam Back, the latter explained that, as Wei Dai and Nick Szabo had already hypothesised, HashCash could be used not only as an anti-spam, but as the basis for a digital cash money system. However, Peter Todd pointed out a problem to Adam: the way computational power works is such that, if this proof of work were transferable between subjects, it would be

hyperinflationaryand the rationale is that with the proof of work you prove that you have incurred a computational cost (of machine time and energy) and the pivotal idea is to make this proof of work transferable, to prove that someone else has spent time and machine and I am just reusing their computational cost already incurred:- A proof of work done in 2001 would be very different from a proof of work done in 2022, as the power of the machines is exponentially greater and would make the 2001 proof of work ridiculous;

- If there was a lot of demand for this ‘digital currency’, the price would go up, the profitability would go up and many people would do the job test, creating more supply. With more supply, the price would fall and very negative economic cycles would arise, similar to the fiat system.

In 2003, the video game Second Life became very famous thanks to a mechanic whereby one could buy goods, services and land (coff coff, metaverse? 😃) within the game with a currency called Linden Dollar, exchangeable both in-game and out-of-game. The game economy was so flourishing –and with monetary policies less stupid than those of the Federal Reserve– that the value of the single Linden Dollar brutally exceeded that of the US Dollar.

As always and by now unsurprisingly, along came the regulator who banned the exchange of the Linden Dollar against the US Dollar and forced the developers of Second Life to peg the Linden Dollar 1:1 against the Dollar. The Linden Dollar then became irrelevant.

Another year goes by, it is 2004, and a chyperpunk called Hal Finney (creator of PGP 2.0) creates the Reusable Proofs of Work (RPOW) finally making HashCash’s proof of work transferable.

The problem of double spending always remained. Simplifying almost incorrectly, it stated that one had to trust the chip (e.g. Intel) that was inside the computer, which would sign the date of the transaction accurately and avoid double spending. It was a trust system of a hardware third party (the Intel chip) that, in theory, should not have colluded with the participants but was not very successful as a solution. We are at the peak because in 2005 Nick Szabo republished bitgold (conceived in 1998) and supposed to solve the problem of double spending not only by generating the currency but also by voting on the transaction history; the concept was similar to Wei Dai’s proof-of-stake, but instead of weighing the votes on the currency staked, he thought of doing it on the basis of the proof-of-work itself. Szabo sought developers, but then in 2006 removed his publication. We are very close to the idea of Bitcoin, almost within a whisker.

Year zero: 2008 #

Two fundamental events happened:

- The patent on Schnorr’s signature expired (even though Satoshi would not use it);

- Yet another economic crisis created by fiat currency was triggered, namely the Subprime Mortgage crisis, orchestrated by various government entities whose task was to inflate a market of mortgages that could never be repaid, based on the manipulation of interest rates artificially lowered by the Federal Reserve.

On 31 October 2008 came the immaculate conception: Satoshi Nakamoto published the bitcoin paper. Curtain.

Satoshi Nakamoto #

Name, domain and hosting #

The first documented trace of Satoshi Nakamoto dates back to 2008, although in various public posts this anonymous user (or group of users) casually commented around the Internet that he had already started working on a project called Bitcoin in 2007. In 2007, somewhere in the world, someone was already working on Bitcoin.

However, the real documented story begins on 18 August 2008, when the site bitcoin.org (which no longer exists) was registered using the Internet service anonymousspeech, which allowed people to pay to register domains anonymously.

At the time, anonymousspeech accepted cash payments physically sent to their premises or through e-gold payments. As a mere matter of continuity between the experiments carried out up to 2008, many are betting that he used the latter to purchase the domain

An interesting fact is that even though we do not know Satoshi’s legal identity, anonymousspeech assigned an ID to each customer, and so we learned that Satoshi himself had bought another domain, this time called netcoin.org, we can say that he was undecided about what name to give his creature.

The hosting information is still in the hands of anonymousspeech (now closed), but very realistically Satoshi will also have used a similar service to pay for his own hosting; probably self-hosting would have been too dangerous, and in order to maintain absolute anonymity, he also preferred to purchase hosting.

Whitepaper #

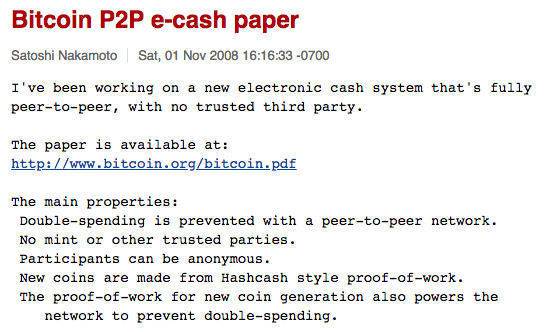

On 31 October, Satoshi Nakamoto’s whitepaper was published, presenting for the first time in a practical and technical way how bitcoin works. Satoshi writes on a mailing list called cryptography (the spiritual successor to the chyperpunk mailing list, which has been closed for several years) saying:

I have been working on a new fully peer-to-peer electronic cash system, without a trusted third party. The paper is hosted at bitcoin.org/bitcoin.pdf" – Satoshi Nakamoto

The main properties it describes on the mailing list are:

- Double spending is prevented thanks to a peer-to-peer network;

- There is no central mint or other trusted party;

- Participants can be anonymous;

- New coins are created through a HashCash-style proof of work;

- The proof of work used for coin creation also serves the network to avoid double spending.

Let us analyse the abstract of the paper:

Abstract. A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial third party. Digital signatures provide part of the solution, but the main advantages are lost if a trusted third party is needed to avoid double spending.

We propose a solution to the double spending problem using a peer-to-peer network. The network marks the time of transactions, placing them in a continuous chain of hash-based proofs of work, forming a record that cannot be changed without redoing all proofs of work. The longest chain not only serves as proof of the sequence of events witnessed, but also as proof that they come from the largest CPU pool. As long as most of the CPU power is controlled by nodes that do not cooperate to attack the network, they will generate the longest chain and outperform the attackers. The network requires minimal structure. Messages are transmitted in best effort and nodes can leave and join the network at will, accepting the longest chain as proof of what happened during their absence.

Satoshi Nakamoto’s whitepaper does not deal with topics such as inflation, central banking or digital gold. It is completely neutral and devoid of political connotations, with a purely commercial narrative. However, in other internet posts Satoshi has expressed his crypto-anarchist roots. Another interesting element is that in the paper Satoshi mainly focuses on solving the double spending problem, taking for granted the necessary technological parts that are taken for granted as:

..digital signatures provide part of the solution…

– Satoshi Nakamoto

Satoshi does not explain in this publication important concepts such as bitcoin’s smart contract language, the script, does not discuss the 21 million bitcoin limit, and halving is not mentioned either.

The first responses to Satoshi’s e-mail are very sceptical, like: ’nice but it can’t work, this stuff doesn’t scale enough’.

Timechain and errors #

The term blockchain was not used by Satoshi Nakamoto in his whitepaper. Instead, he used the terms chain of blocks, chains of proofs of works and chain of hash-based proof-of-works to describe what he was talking about. In the code, he often used the term timechain to refer to the sequence of blocks. This name was chosen simply to establish the chronological order of the blocks. However, some, such as Peter Todd, have objected to the use of timechain in relation to Satoshi’s misuse of the term timestamp, which literally means “stamp guaranteeing that a certain piece of information exists” at a certain time, as if it were proof of existence. Bitcoin does not need a proof of existence, but a proof of uniqueness or rather of the existence of non-alternatives.

-

Satoshi has misused the term

timestampbecause Bitcoin does not need a stamp that guarantees the existence of a particular piece of information, but a proof of uniqueness. For example, if I sign two transactions, one in which I state that it will rain tomorrow and one in which I state that it will be fine weather tomorrow, and then I disclose the first transaction if it rains tomorrow and the second if it is fine weather tomorrow, I am violating the uniqueness of the transactions, I am double spending. Peter Todd correctly observed that the more appropriate term to use would besingle-use-sealsinstead of timestamps. Giacomo Zucco suggested that the proof of uniqueness should be calledtimesealing. However, we can forgive Satoshi this error, since in 2008 the literature on cryptographic time evidence was not yet well developed; -

Satoshi often mentions the term CPU in his paper. Today, however, it is impossible to do mining using a CPU because it is too unspecialised. CPUs can do anything (emulate any Turing machine), but GPUs are more efficient because they can only do certain things, such as video games or 3D simulations. Subsequently, we moved from GPUs to FPGAs (generically printed programmable boards) to ASICs, which are designed exclusively for bitcoin mining. However, this is not a serious mistake on Satoshi’s part, as he could not have foreseen the technological evolution of the last 14 years.

-

Satoshi often talks about the longest chain in his paper, but this is a mistake because if so we would simply take the genesis block, use one of our ASICs to start mining all the blocks every 10 minutes without ever triggering the difficulty adjustment. The result would be that, since the difficulty is low, we could create a chain much longer than the original and present it as such. The solution to this problem (which is also an error in Satoshi’s source code) is to check the

heaviest chain, i.e. the one with the highest cumulative amount of work, which is obtained by multiplying the length of the chain by the difficulty coefficient of each block. -

Satoshi uses the term

nodeloosely in his paper, describing nodes that do mining, manage wallets, manage consensus, and manage peer-to-peer connections. Over time, nodes have become specialised: for example, nodes that do mining are no longer generic software that does validation, but are software specifically designed for this purpose. The nodes on our computer no longer do hashing, but only validate transactions, while the wallets on our mobile phone no longer do validation, but only generate keys and transactions. Furthermore, signing devices (such as hardware wallets) do not even do transaction composition, fee selection or coin selection, but only do transaction signing. -

Regarding the SPV (Simplified Payment Verification), Satoshi believed that it was not necessary for everyone to download all the blocks, but that it was sufficient to download only the header (which contains the merkle root of the transaction). In this way, it was enough to trust that if a transaction existed within the merkle root, it meant it was valid and we could assume this to be true by trusting the miners. However, if someone found an invalid transaction, they would report the error and everyone would download the entire block. The problem is that all it takes is one malicious node that starts reporting all blocks as fake for every light client to start downloading everything and become a full node.

-

With blockchain, all transactions are public, but the privacy model is new: everyone can see the transactions, but the physical identities connected to the transactions are hidden. It becomes important to hide the relationship between public keys and an individual’s identity. As an additional security measure, it is recommended to use a new set of public and private keys for each transaction. It is also recommended not to reuse addresses. Satoshi says: ‘some linkage is unavoidable when there is a transaction with many inputs, as it indicates that the person who is executing the transaction is the owner of all addresses in the transaction’. In reality, this is untrue, since several people can put together several inputs. We will examine the concept of CoinJoin in more detail later.

-

The whitepaper does not describe bitcoin as we know it today: there is no mention of the 21 million limit, halving, UTXO set, smart contract scripts or automatic difficulty adjustment. Bitcoin 0.1 does not descend from the whitepaper; the whitepaper was created to solve the main problem, namely double spending.

Genesis block and Patoshi #

A group of cryptographers revealed that in November 2008 Satoshi contacted them to pass them a code dump for a private review, very similar to the public code that was released in January 2009.

Two interesting things about the private code:

- Implements a peer to peer poker system in the code (removed later to keep the focus on bitcoin);

- Implements a decentralised market system with a complex merchant reputation system (removed later to keep the focus on bitcoin).

On 3 January 2009, the first Bitcoin block was mined: the source code was released on Sourceforge on 9 January, but it had already been circulating among various figures since November 2008; the genesis block, i.e. the official start, is dated 3 January 2009, and in this first block, Satoshi writes

The Times 03/Jan/ 2009 Chancellor on Brink of Second Bailout for Banks

– Satoshi Nakamoto

Interesting facts about The Times image:

- A Gordon Ramsey advert in which he invites people to eat out for just £5 (amazing how in 14 years fiat inflation has exploded)

- A beer at the bottom, purchasable for £1;

- Israel sending troops into Gaza. Eternal war in the Middle East, links to the petrodollar? Perhaps this actually could fall into conspiracy.

What is the purpose of all this on Satoshi’s part? Certainly an interest in the monetary topic and economic crises, another is the proof that he and others started mining on 3 January; the first block was not created weeks before and then the code was released: the genesis block was created exactly on 3 January 2009. A demonstration that neither he nor anyone else executed a hidden proof-of-work for some kind of advantage. To make matters worse, the bitcoins Satoshi allocated himself after mining the first block were not spent because… they were not spendable! All these elements denote a profound transparency towards Satoshi.

Satoshi is said to have mined 1.3 million bitcoins for himself: there is no real proof and this claim is completely gratuitous and improbable. The origin of this legend goes back to researcher Sergio Lerner in 2013, who examined the first blocks and observed how they handled the nonce. Each block in Bitcoin has a header that contains several fields: date, hash of the previous block, difficulty, merkle root of all transactions and the nonce: a random number that the miner must enter and keep changing until the hash matches the current difficulty.

Sergio examines all the blocks and notices that some consecutive blocks do not have the nonce starting from 0, but continue with respect to the nonce of the block previously validated with respect to the one under examination. Sergio therefore finds it credible that a single entity throughout 2009 mined so many blocks that it obtained around 1.3 million bitcoins. That entity detected a pattern, and so Sergio called it Patoshi.

The main objections are not to the fact that Patoshi exists (very likely), but that Patoshi is in fact Satoshi. Let us analyze the counter evidence:

- Satoshi has gone to great lengths to demonstrate the fairness of the genesis block via The Times newspaper page, clearly demonstrating that he did not work ‘alone’;

- When the source was not widely circulated (before it was posted on SourceForge) Satoshi did not pre-mine anything;

- When Satoshi personally sends bitcoins to Hal Finney from one of his coinbases, he mines them from a block that does not belong (in an obvious way) to Patoshi’s pattern.

Last post, fork and farewell #

On 11 February, Satoshi created a profile on the [P2P Foundation] forum (https://p2pfoundation.net/) with the date of birth the day Roosevelt confiscated the gold and the year of birth the day Nixon ended the gold standard.

In his first post, he explains that he has developed this fully decentralised peer-to-peer ecash system and posts the link to bitcoin.org, adding:

The main problem with conventional currency is all the trust required to function, the central bank must be trusted not to inflate, but the history of fiat currencies is full of betrayals of this trust not to inflate.

– Satoshi Nakamoto

Satoshi’s tone begins to be more political than the whitepaper.

On 29 October, Satoshi was convinced by some developers to move Bitcoin’s code from SourceForge to GitHub, a system better suited to Linux operating systems. Gavin Andresen was in charge of the migration and soon other important developers joined them on GitHub. On 22 November, the Bitcoin forum moved to a new forum called BitcoinTalk, run by users theymos and cobra.

Among the developers who intervened at this time was Mike Hearn, a Google developer who began the discussion by proposing the absolute standardisation of Bitcoin as a term of protection against the threat of closure by central state powers. Gavin Andresen also became a strong supporter of this policy.

Satoshi meanwhile makes changes to the source:

- On 28 July 2010 he performs a soft fork due to a bug in

OP_RETURN(not exploited by anyone) that would have allowed anyone to spend any bitcoin. The OP_RETURN is an operation that allows a data message of up to about 100 bytes of data in a transaction; - On 31 July 2010 he does another soft fork: some users were having problems with upgrades, Satoshi removes two

OP_CODEs and then does a hard fork introducingOP_NOPs which basically do nothing but with a future soft fork could have been used to do something else - Another subsequent hard fork is performed to separate the evaluation of

scriptSigfromscriptPubKeywhich are two key components of the value transfer system in Bitcoin. The ScriptSig is a string of code within a Bitcoin transaction that contains the digital signatures of the participants in the transaction and other information needed to verify the authenticity of the transaction. ScriptPubKey, on the other hand, is a string of code present within a transaction output that specifies the conditions that must be met in order to spend the money contained in that output. Together, ScriptSig and ScriptPubKey form Bitcoin’s spending mechanism, which ensures that only legitimate Bitcoin owners can transfer funds to other addresses. The bug found by Satoshi allowed everyone to spend bitcoins even if one was not the owner of those funds; - On 15 August, a

value-overflowbug was discovered. It is very dangerous because entering a higher value than the varaible can hold causes another unpredictable number to appear. This bug is exploited for 51 blocks and 184.5 billion bitcoins are generated. Satoshi notices this, restarts the chain of 51 blocks by rolling back the chain. This is not a justification but this only happens a few months after the launch of bitcoin and is entirely justifiable; - On 7 September another fork takes place that adds the limit of signature transactions to 20 thousand, otherwise it would have been possible to create a transaction that blocked a node because it asked to verify a disproportionate number of signatures;

- On 12 September, Satoshi performed another soft fork, adding a blocksize limit of 1 megabyte to the block;

After 12 September, the story of Satoshi’s upgrades stops, but two important facts happen:

- On 11 December 2010 comes Satoshi’s penultimate public message: someone reports in a newspaper (Business Insider) an article in which WikiLeaks opens up the possibility of adopting Bitcoin to receive funding, given the block imposed by Visa and Mastercard. Satoshi responds by officially asking WikiLeaks not to make this move:

WikiLeaks has kicked the hornet’s nest, and the swarm is headed towards us. [I make this appeal to WikiLeaks not to try to use Bitcoin. Bitcoin is a small beta community in its infancy. You would not stand to get more than pocket change, and the heat you would bring would likely destroy us at this stage.

– Satoshi Nakamoto

Satoshi states that ‘for now’ Bitcoin is too small for a direct battle with the US state.

- On 12 December 2010 at 18:22:33 Satoshi gives us his last post in which he says: “there is a lot of work to be done “. In an email dated 23 April 2011 (for which there is no cryptographic proof) Satoshi writes to Mike Hearn that he wants to appoint Gavin Andresen as his spiritual successor.

The puberty of protocol #

Adoption #

In 2011, Bitcoin became popular with its adoption by the Electronic Frontier Foundation, a foundation dedicated to promoting civil liberties on the Internet. However, in June of that year, they stopped accepting Bitcoin due to fears of legal repercussions for receiving donations in cryptocurrency. In February 2011, Austrian school and free market enthusiast Ross Ulbricht founded under the pseudonym Dread Pirate Roberts The Silk Road, an e-commerce site that sold goods and services on the TOR network. The Silk Road had some ethical, but not moral, religious or political restrictions, e.g. no stolen goods or stolen credit cards were allowed, but books or psychotropic substances were allowed.

The Silk Road only accepts Bitcoin, the first real use case is born.

First shitcoin and BIP #

On 17 April 2011 the first utility coin called namecoin was born, which compared to those of 2022 is also quite honest, so it is not a real shitcoin:

- There is no ICO;

- There are no marketing departments;

- There are no lies in the way it is described;

- There is no super technical crap.

The main purpose of Namecoin was to offer a decentralised alternative to the domain name resolution system (DNS) currently used on the Internet, which is managed by centralised entities such as ICANN (Internet Corporation for Assigned Names and Numbers). It aimed to provide a name resolution system resistant to censorship and tampering by governments or other centralised actors, making it more difficult for Internet users to be excluded or restricted in their access to certain websites or online services. It also offered a certification system for domain names, allowing users to prove ownership of a domain name in a decentralised manner and without the need for centralised third parties. All this with a new termination in the browser: .bit. Given the scalability problems on Bitcoin’s timechain it seemed logical to flood it further, so further was to create another chain from scratch that instead of reinventing mining, merge mining is performed.

The technique of merge mining allows the hash of the secondary chain block (namecoin, in this case) to be embedded in the coinbase of the main chain block (Bitcoin) being mined.The embedded hash is preceded by a short descriptive text called a ’tag’ that allows the secondary chain to easily locate it. Being a separate chain, however, there was a problem, which gave rise to scamcoin:

The second most famous shitcoin is litecoin, an entirely different beast to namecoin immediately and demolished by Bitcoin developers.

The creators of litecoin asserted a number of completely nonsensical assumptions:

Assertion: Bitcoin is stupid because blocks are created every 10 minutes, we will make quick blocks about 2 seconds.

Bitcoin developers' response: Satoshi did not set the 10 minutes randomly, but because at the same hashrate if you have a block after 1 minute it is not worth as much as one made every 10 minutes but is logarithmically worth less than 1/10. There is no more security if the blocks come sooner. Secondly, with a higher granularity you have more chances of orphan rate: if blocks are found more frequently, much more often two blocks will be found at the same time and therefore there will be many parallel chains in which one loses and one wins; this means that the profitability of the miner becomes much lower, giving much more incentive to big miners than to small ones because the variance increases.Statement: we will have lower fees than Bitcoin;Answer: we will discuss this narrative in the next section which will be entirely about the blocksize war.Statement: it is not ok for Bitcoin to be mined with GPUs, we will not use sha256 and will create an algorithm called GPU resistant script;Bitcoin developers' response: no resistance, script is still an algorithm and a way will be found to make it feasible and scalable for GPUs, albeit slower. Increasing the complexity creates an entry barrier such that the first one to find a way to do it with the GPU will have a competitive advantage over the others.

litecoin has some obvious problems: firstly, more blocks were mined on the first day of launch than might have been expected. Furthermore, litecoin is often referred to as the ‘silver of Bitcoin’, i.e. a less valuable currency than gold. However, this statement makes little sense, as both currencies are digital assets and therefore already divisible by nature. Unlike gold, which is easily transportable but not very divisible, or silver, which is less transportable but very well divisible, digital assets can always be divided and are easily transportable.

On 19 September, a chyperpunk developer called Amir Taaki had a brilliant idea: to create the `BIP (Bitcoin Improvement Proposal) process. This system allowed (and still allows) anyone with a Bitcoin proposal to follow a structured path to submit it. Specifically, the proposal is discussed in a feedback-gathering phase, then structured with an abstract, a preamble, detailed specifications, justifications, compatibility with other systems, and a reference implementation. Once the proposal has been formalised, it is presented to a group of people who maintain the Bitcoin repository without going into the substance of the matter. These people do not decide whether the proposal is valid or not, but simply assign a number to each BIP submitted.

Benevolent dictator #

The BIP 30 – Duplicate transactions was created to solve the problem of transaction collisions, the phenomenon whereby two transactions can have the same transaction ID. This BIP is nothing malicious or strange but Gavin Andresen, who claims to be Satoshi’s heir apparent is the self-proclaimed head of Bitcoin and decided that at some point (15 March 2012) the soft fork for this BIP would be activated

Who has determined that Gavin is now the new leader?

In January 2012, Gavin proposed the BIP 16 – Pay to Script Hash which allows transactions to be sent to a script hash (addresses starting with 3) instead of a public key hash (addresses starting with 1). The difference is that if I want to pay with a smart contract with two or more public keys, I cannot pay for one address but have to pay for a contract that has several public keys in it. The idea is beginning to circulate that it would be much smarter to also allow payment to the hash of a smart contract. It is complex, but the concept is that instead of paying and in the output writing: “I pay to this key, or to this key, or to this other key” I write all these conditions, I execute the complete hash and in the timechain I write: this money is paid to the hash of this smart contract; when I spend the money, only then will I reveal the smart contract I want to solve with enough signatures to do so. It is an efficient solution both in privacy because smart contracts are more private until they are spent and also in scalability because they are only entered into timechain when they are spent and not when they are created.

However, a strong argument starts because Luke Dashjr analyses BIP 16 and thinks it is very badly done and proposes BIP 17 – OP_CHECKHASHVERIFY (CHV). Luke is insistent because Gavin wants to make a radical change in the way the transaction is validated, which he assumes:

- The fact that the hash is checked before the script;

- The fact that the way it is represented is completely changed;

- The limits of sigops are changed;

- The new OP_EVAL operator is dangerous because it allows recursive loops to be created.

Luke judges that it is pointless to hash the script, it would be much better to make the merkle tree of the script so that then only certain pieces of the script can be revealed. Gavin disagrees and decides to put a flag date of 1 February 2012.

As a side effect, the developers split into factions and as a first step force Gavin to remove the OP_EVAL because it creates problems with heavy Ethereum-style attacks. They also demand the inclusion of a treshold activation mechanism, with miner signalling. If at least 55% of the miners had given the OK in their blocks there would have been consensus.

Not only miners, all users must reach consensus and in fact this flag date failed miserably and with a post on bitcointalk on 27 February Gavin announced that:

Even if we did not reach 55%, I decide that BIP 16 will be activated from 1 April 2012 anyway (and it is not an April fool’s joke).

– Gavin Andresen

In block 170060, a transaction was mined and invalidated because it was not enforcing PS2H. It is estimated that up to December 2012, 45% of the miners continued to have their blocks orphaned because they did not agree with P2SH at all.

In September 2012, the Bitcoin Foundation was created, based in Washington DC and inspired by the hierarchical structure of Linus Torvalds’ Linux Foundation. According to Mike Hearn’s advice, the idea was to give Bitcoin a more organised structure, choosing a benevolent dictator like Gavin, who had been appointed by Satoshi himself via an unverifiable email sent to Mike Hearn. The Bitcoin Foundation also gained prestige in the media, becoming the official point of reference for journalists who wanted to talk to the “leaders of Bitcoin”. However, this also created one of the first major battles within the Bitcoin community, with some trying to present the Bitcoin Foundation as a reassuring institution that avoided talking about tax evasion, money laundering, etc. while others were more interested in explaining the reality as it is. In explaining what Bitcoin really stood for.

Pre blocksize war #

On 11 March 2013, there was a serious problem during Bitcoin’s protocol upgrade, which saw the replacement of the Berkeley DB database with LevelDB. The issue was that Satoshi Nakamoto had set a maximum block size of 1 mb, a limit accepted by the community as of September 2010. However, there was an implicit, unspoken limit smaller than 1mb within Berkeley DB. Consequently, although 1 mb blocks were valid at the consensus level, they were not valid at the database level and were therefore rejected. With the adoption of LevelDB, some nodes started to accept blocks of 0.9/1mb, causing the chain to split. In this general chaos, an unintentional double spending attack was successfully carried out: a transaction that was present on the old chain ended up on the new one by accident, and the merchant who had received about 9000$ saw it disappear under his nose once the chain was reorganised. Everything was caused by a consensus problem due to the change of technology at the database level.

On 14 June 2013, Wikileaks returned to accepting Bitcoin but bad news was not long in coming as on 2 October the creator of the Silk Road after a months-long manhunt was arrested and sentenced to two life sentences without the possibility of parole for creating the e-commerce.

As part of the investigation, it was discovered that an FBI agent who had participated in Ross’s arrest had stolen most of his Bitcoins. Furthermore, when Ross was arrested, he was in a public library and was accessing the site’s control panel as an administrator. While he was focused on the screen, some officers staged a fight behind his back, attracting his attention. Meanwhile, other agents handcuffed him. All the Bitcoins on the site were confiscated, but some of them disappeared due to the corruption of two agents, one of whom was later arrested.

Unfortunately, the bitcoins were managed by a ‘hot wallet’ and were withdrawable from the interface of the site itself.

In 2014, the Bitcoin Meetup was founded in Milan, soon becoming the largest and most influential in Europe. However, shortly afterwards, another blow arrived because in February of that same year, the exchange MtGox suspended withdrawals and declared bankruptcy due to a cyber attack. The closure of MtGox gave rise to the first chain-analysys companies and, in China, led to the banning of bitcoin and Baidoo’s outright ban on accepting bitcoin.

In 2015, Giacomo Zucco founded BlockchainLAB in Milan with the aim of bringing together the world’s best bitcoin experts in one office. Developers were free to work and do whatever they wanted, as long as they shared their knowledge and created reports that BlockchainLAB would then sell to banks and institutions. This took place in the office on via Copernico in Milan, where many important future events would take place.

Blocksize war #

Background and directions #

The blocksize war officially began in 2015, but to fully understand it, a brief excursus is necessary:

- On 15 July 2010, Satoshi introduced the 1 mb block size limit, which was activated in September 2010. On 4 October 2010, developer Jeff Garzik released a new client with a patch that removed the block size limit introduced by Satoshi. At this point, Theymos, owner of Bitcointalk and r/reddit, responded by saying not to use Garzik’s patched version because otherwise those who would use it would be cut off from the network. Satoshi replied with “+1 Theymos” and Garzik for his part told Satoshi that it was not so much a question of being forked or not, but was more a question of marketing: if one day there were the transactional levels of Visa, this blockchain limit would limit the amount of transactions. At that point, Satoshi replied that if it was necessary to change the block size, it would be done in the future, but in a controlled and slow manner.

- There are three relevant facts in 2011:

- On 7 March 2011, Mike Hearn was the first Bitcoin developer with a salary. Google had a policy that allowed their employees to devote 20 per cent of their time to personal projects, as long as they were reported in advance. Mike Hearn proposed Google to work on BitcoinJ to bring Bitcoin to Java;

- On 23 April 2011, Mike Hearn revealed an email exchange with Satoshi stating that Gavin Andreesen would be Satoshi’s spiritual successor;

- On 5 May 2011, a new user joined bitcointalk:

Gregory Maxwell, one of Bitcoin’s most prolific researchers and developers, known as the “ultimate villain” for big blockers. He presented himself with a long post in which he supported the block size imposed by Satoshi, as it not only avoided the risk that blocks might not be downloaded in time or cause the orphan rate to rise, but also as a purely economic matter; if there were no limit the space would be infinite and consequently the miners’ fees would be very low; the inflationary subsidy becomes too low (remember that in 2140 it will reach 0) since we know that the price is only formed on scarce goods, if the space on the block is not scarce it has no price and nobody would want to pay it.

- In 2012 the second fully paid employee to work on Bitcoin is Gavin Andresen;

- In 2013 Mike Hearn convinces Gavin to rename bitcoin to Bitcoin Core;

- In May 2013, Peter Todd became another villain for the big blockers by publishing the website keepbitcoinfree.org, where he posted a video with a Hollywood production explaining that the issue of blocking was not a technical choice, but a moral one, and that there were two visions: one that wanted to centralise Bitcoin by giving miners the opportunity to take control of it, and another that was free and verifiable by everyone;

- Shortly afterwards, on 19 August 2013, Gregory Maxwell launched the idea of

coin witnessby publishing on bitcointalk the article Really Really ultimate blockchain compression: CoinWitness. The first side chain idea. Greg said:

We could have many blockchains and on the bitcoin blockchain we could use something called

SNARKswhich is used to produce small compact proofs for long histories. We could implement an operator in bitcoin that validates SNARKs and in this way you would have entire blockchains living off bitcoin; the advantage is that we can freeze a bitcoin on the main chain and create a side coin on the side chain and when it comes back our node would only have to validate a compact proof of its history; this would improve scalability it would allow experimentation without creating shitcoins.

– Gregory Maxwell

- On 14 October, Adam Back published a paper called

Bitcoin Staging, in which he explained that it was nice to experiment with bigger or smaller blocks and different privacy tradeoffs, but it was not nice to do so by creating new shitcoins. Maxwell’s idea could be used by creating side chains; - Gavin relinquished control over GitHub and passed the role to Wladimir Van Der Laan; he did not present it as a reduction of his own power, but as the fact that maintaining the repository was a demanding role, while he had to do more important things;

- On 23 October 2014, the whitepaper on side chains was written. In this paper, it was stated that the idea of Coin Witness with SNARKs still wasn’t feasible, but with a Satoshi-style “sort of SPV” these separate chains could be created, in which the coins could move around experiencing various trade-offs of privacy, speed and scalability. Signing this whitepaper were Adam Back, Gregory Maxwell, Matt Corallo, Luke Dashjr, Pieter Wuille, Andrew Poelstra, Andrew Miller and Jorge Timón. All of these developers, however, made a mistake: they created a conglomerate that was too big and with too many names, which created the impression of ‘centralisation’ in Bitcoin;

- On 27 December 2014, Mike Hearn launched

BitcoinXT, an alternative client that reproduced and completed Bitcoin. The XT version arose because Mike had shortly before created the BIP 64 – getutxo message but this BIP was not implemented in Bitcoin with sufficient speed and here Mike Hearn decided to create an alternative version of the client that contained several small differences with the original, including the BIP 64.

Having said that, we can now start with the blocksize war proper: the main topic will be that of the maximum size of a block in Bitcoin and thus a purely technical topic concerning:

- The validation time to download a timechain block;

- The propagation time, which may or may not create orphans;

- The possibility of selfish mining;

- The possibility for a large miner to challenge smaller miners;

- The management of fees.

All these technical questions open up another set of issues such as:

- How to change the blocksize, fast or slow?

- Should it be changed with a hard fork that is not backward compatible or with a soft fork?

- Do we change it dynamically or in a fixed manner?

We will then address the problem of the need to scale large off-chain blocks quickly, then the question of the effectiveness of off-chain practices such as the lightning network or side chains. Two other topics of discussion will concern Satoshi’s original idea that a few large data centres can have real nodes, but that the whole economy remains protected by the SPV protocol, and governance: who decides the changes? The miners? The developers? The Bitcoin Foundation? The exchanges? Or is it the users who decide?

Finally, we will analyse the debate on forum moderation in relation to freedom of expression.

Blockchainlab and the first quarrels #

In January 2015, Giacomo Zucco’s Blockchainlab was founded, a consulting company that would function as an incubator for Zucco`s startups, which at the time had a business model based on losing money by doing cool things on Bitcoin, so that was OK.

Blockchainlab’s business model was to go to all Zucco’s clients, sell advice and training on Bitcoin not offered by Zucco, but by a team that gathered the expertise of the biggest startups and developers on Bitcoin, as well as acting as an incubator for new startups. The first incubated was Riccardo Casatta’s Geobit (who would later create Eternity Wallet) and later other figures joined, including Franco Cimatti, one of the oldest Italian bitcoiners who translated the Italian Bitcoin client receiving credit from Satoshi himself.

Shortly after, the ‘startup incubator’ part goes out the window because Zucco realises that most of these startups did not have a business model and did not want to have one. Instead of shares, the business model with which Blockchainlab consolidates is to be a research lab for developers, drawing from them privileged information to package and resell; an exchange between help services in exchange for information.

In February 2015, Thaddeus Dryja and Joseph Poon published the first paper on lightning network and only 3 months later, on 15 April 2015, a major conference took place in London during which Gavin gave a speech called Why we need the bigger chain where he expressed the need to want much bigger blocks and that Satoshi’s limitation had to be eliminated.

After the speech, in a Q&A, Gavin is asked: what happens if there is no consensus on the blocksize discussion? and Gavin answers candidly: we will do as I say, as has already happened with P2SH. This answer leaves one quite stunned, and in fact, on 7 May, the first friction arises: Wladimir Van Der Laan (the new maintener of the GitHub repo) states that he does not agree with Gavin on increasing the block size: he warns that enlarging the block is dangerous and premature, especially without the consensus of the community.

At this point on 29 May, Gavin issued an ultimatum, stating that Mike Hearn would implement the largest blocks in the alternative BitcoinXT client, and on 22 June Gavin released the BIP 101 – Increase maximum block size which in simple terms expands the maximum block size from 1mb to 8mb, and then doubles it every year.

Gavin states that by Moore's law the storage space of hard disks doubles every year, too bad the problem is not storage space but:

- The bandwidth that does not double every year following Moore’s law;

- The computing power to check figures, do validation, etc., does not double every year.

Gavin’s rationale for choosing 8mb was that he and Mike initially planned to expand the blocks to 20mb; the Chinese miners (who accounted for over 60% of the hash-power) were against this because they would be cut off from the network due to government firewalls. China therefore accepted 8 mb as a compromise. Later, Mike revealed that they chose 8 mb because the number 8, in Chinese tradition, means prosperity and wealth and was meant to please the Chinese miners (a great scientific motivation 😁).

Garzik then makes two proposals:

- BIP 100 – Dynamic maximum block size by miner vote: since the block size is voted on by a majority of the miners, if the miners have a majority they decide the block size. This is a controversial proposal because clearly a block that is too large allows one miner to throw smaller miners out of the market; if one miner were to reach a majority it could self-vote a larger block to put the entire minority out of the market, definitely dangerous;

- BIP 102 – Block size increase to 2MB: quicker solution: proposes doubling now, moving the problem “in a few years”. Even this proposal is not appreciated, many wonder what is the point of doing a hard fork just to avoid a problem that will recur in a few years.

Pieter Wuille (a.k.a. ‘sipa’) then intervened, proposing the BIP 103 – Block size following technological growth saying: let’s do a hard fork increase now, but not double, let’s increase by 17.7% until 2063. Sipa quotes maintener Wladimir and Greogory Maxwell thanking them at the end of BIP for positive feedback. Turns out Gregory will say: I am quoted in the acknowledgements, but my feedback is: don’t do it.I totally disagree with Sipa.

The most aggressive of them all is Adam Back who agrees with Garzik on BIP 102 because he considers it “safe” and jokingly proposes BIP 248 in which he says: let’s double right now to 2 mb and with the next halving we’ll go up to 4 mb, with the next halving to 8 mb and so on; in the meantime, off-chain and side-chain technologies will have mitigated the problem.

Adam Back is a Garzik-like big blocker, in total disagreement with Gregory Maxwell and Luke Dashjr. On one point, however, they agree: without total consensus a hard fork will not happen.

The coin of a thousand narratives, Bitcoin Jesus #

On 30 July 2015, Ethereum was (unfortunately) born: Vitalik Butarin, a very young and talented journalist published a series of articles (commissioned by Jimmy Song) on Bitcoin 2.0 protocols for ‘doing assets’ on Bitcoin. Vitalik reaches the correct conclusion that on Bitcoin, assets must be managed differently because miners do not enforce asset rules (which is the same logic that will later lead Peter Todd and Zucco to work on current issues such as RGB). The birth of this shitcoin is however important to mention because it is part of the Bitcoin story even though it has always had a thousand different narratives:

- The first narrative is “we have to make assets better than Bitcoin”;

- The second narrative is “environmentalism, we will use proof-of-stake rather than proof-of-work”;

- The third narrative is “let’s extend the language of smart contracts to do distributed generic computation”;

- The fourth narrative is like that of litecoin “low fees and fast, wide blocks”.

Vitalik becomes - albeit on another chain - an ardent supporter of big blockers and according to his vision there is no limit to the scalability of blocks, you can put anything you want in them, all smart contracts and data should be on the blockchain and the blocks should be big and with low fees.

I take this opportunity to share the moderate opinion of Giacomo Zucco on Ethereum:

I consider Ethereum to be one of the worst scams in the industry, so anyone interested in Bitcoin should absolutely ignore it and not contaminate something as serious as Bitcoin. It has all the characteristics of centralisation of development typical of altcoins, but made worse by historical precedents such as the TheDAO bailout and the ‘ok can you guy stop trading’, as well as the episode of the coin dumping and pumping depending on fake news about its creator. It has all the issues of unsustainability of scale caused by a basic misunderstanding of the trade-offs of a blockchain (“we want everything onchain”) of typical “big block” scamcoin, which makes nodes technically centralised. It has all the security flaws typical of the pseudo-technical super-bullshit of those who do not know what they are doing (to date it has proved impossible in Ethereum to even make a simple multisig secure and not be ‘accidentally killed’ by a random user… let alone complex ‘smart contracts’). It has all the moral, ethical, legal and distorted economic incentive issues of premined coins and ICOs at the same time. It has all the fraudulent “no, it’s not a coin, it’s an appcoin” rhetoric typical of ICOs. It has a change of narrative every month to ignore false promises debunked by facts and launch new false promises for the future (world computer with appcoin, nay no turing completeness, nay no unstoppable applications, nay no rich statefullness, nay no collectible kittens, nay no defi, nay no open finance, nay no store of value, nay no..). It has a creator who used to sell scams about ‘quantum computing emulated on normal computers’ before launching this scam (like someone who sells healing crystals and time machines, basically). It has a site where a phrase from TheDAO’s bailout stands out as a full-fledged commercial scam (‘unstoppable applications’). It has a validation infrastructure completely centralised by one company (infura). It has a ‘road map’ for ‘2.0’ that represents a declaration of failure across the board covered in science fiction promises. I think it’s even worse than stuff like Bitconnect, Dentacoin or BSV, because on the latter, even if a few traders made money or lost money on it, no guy threw away reputation, skill, talent and time. Ethereum, on the other hand, has diverted a lot of potentially valuable intellectual resources.

– Giacomo Zucco .

On 15 August 2015 the blocksize war officially begins. Gavin and Mike together in a blog post release a communication saying that BitcoinXT in the new version will implement Gavin’s BIP 101 and that Gavin no longer directly supports Bitcoin Core. There will be no miner voting, there will be direct activation.

It has been almost 5 years since Satoshi’s passing and magically an email arrives from one of his addresses in which he writes:

I followed the recent debate, I hoped it would be resolved with a general consensus but with the release of BitcoinXT 0.11a this seems impossible and I am forced to share my concerns about this very dangerous fork. The developers of this “wannabe Bitcoin” say they follow my original vision but nothing could be further from the truth. When I designed Bitcoin I designed it in such a way that making future changes would be difficult or almost impossible without global consensus. I designed it to protect it from the influence of charismatic leaders even if they were Gavin Andresen, Barack Obama or Satoshi Nakamoto. They use my old writings to say that Bitcoin had to be a certain way but even I could be wrong and many things have changed since then. If two developers alone can change Bitcoin and redefine it as they see fit then I will have to declare Bitcoin a failed project.

– Satoshi Nakamoto

This message is not demonstrably verifiable as having been written by Satoshi himself, but the substance does not change: even if it were Satoshi who had written it, it would still be a defeat to have to make the future of a decentralised protocol depend on its very creator.

On 17 August 2015, Theymos announced a new policy on Bitcointalk and r/bitcoin. Until then, only BitcoinXT was being discussed and almost all posts monopolised the two boards. Theymos states that something was being discussed that breaks the Bitcoin consensus, hence an altcoin. As the owner of the forum, he urges all those who wanted to talk about altcoin to go elsewhere: the policy would be to delete posts related to shitcoin. BitcoinXT is confined to the category of altcoins on Bitcointalk, while on Reddit it explicitly says that it can no longer be talked about.

Roger Ver, known as Bitcoin Jesus, discovered Bitcoin in 2010 and became a staunch supporter. He is a super libertarian who even renounced his US citizenship and invested in small Bitcoin startups; Roger has no great technical knowledge, but was just trying to politicise Bitcoin a bit against Gavin, Mike, Luke Dashjr and Gregory, who instead wanted to keep it more neutral and less scary. On the topic of blocksize he doesn’t care much about blocksize, but he was pushing the rhetoric of Bitcoin spending versus saving so much (I’d add thank fuck when you’ve made millions with Bitcoin :-D). He totally freaks out when he writes a post in support of Gavin and Mike, but this post gets banned by Theymos. The ego affront is total for Bitcoin Jesus, he just can’t be banned from the official board. As a result, Roger Ver becomes one of the most ardent opponents of r/bitcoin, Bitcointalk, Blockstream or Bitcoin Core, and turns into the most fervent supporter of big blockers (and every other possible shitcoin, afterwards).

On 24 August, BitPay, blockchain.info, Circle, BitGo, KnCMiner, itBit and Xapo sent a public letter stating that they had discussed with Gavin, the leader of bitcoin, and realised that the way forward was to increase block sizes. They agreed and decided to support Gavin. The entire industry decides to support BitcoinXT which seems to have the victory in the bag because it seems to have come by a choice structured by the captains of the industry which is worrying because it has political implications: is bitcoin governed by a consensus that cannot be changed or by entities that are legal and regulated mainly in the US? It seems a very easy market to regulate because if the US government takes over it immediately becomes censurable like the Linden Dollar, e-gold or PayPal were.

SegWit and the fake Satoshi #

After two weeks, Pindar Wong (former member of the IETF | Internet Engineering Task Force (informal group of engineers who developed the TCP/IP protocol) suggests to stop continuing to write blog posts but to resolve the issue by looking straight into each other’s eyes and asks Gregory, Gavin, Adam and company to discuss it in person during the Scaling Bitcoin Phase 1 conference on 12 September 2015, in Montreal.

Very timidly in the general marasmus of the conference, Gregory starts arguing with Gavin and this amiable exchange turns into a real debate when you realise that there are about 80 people present to listen to the points of view of the two developers; after about 40 minutes Gregory breaks up the meeting by stating that it was not fair for the two of them to decide the fate of Bitcoin, but that it would be appropriate to let those who had something to say about it speak, or better yet, write it all down on a board.

On 6 December the second episode of Bitcoin Scaling takes place, this time in Honk Kong. During the first instalment (apart from the discussion between Gregory and Gavin) the conference had been more dominated by the presentation of lighining networks, this time it is dominated by a proposal by Petere Wuilla called Segregated Witness; SegWit aims to improve the scalability of the Bitcoin network by increasing the number of transactions that can be included in each block and reducing the consumption of transaction storage space. The way SegWit achieves these goals is by separating the transaction signature data (called ‘witness’) from the rest of the transaction data. In this way, the transaction size can be reduced, allowing multiple transactions to be included in each block without exceeding the 1 MB size limit per block. In addition, Luke Dashjr finds that with SegWit, it is possible to slightly increase the maximum block size without performing a hard fork.

During Honk Kong, a major player emerged, Jihan Wu, CEO of Bitmain (a company that produces ASICs with a world market share of 80 per cent), who claims that SegWit is liked as a hard fork, not as a soft fork. We will understand the reason for these words later.

On 3 January 2016, Coinbase CEO Brian Armstrong announces his support for BitcoinXT, publicly downgrading Bitcoin Core. However, there is a problem because on 14 January Mike claims to have been in Honk Kong and realised that the majority of miners do not want BitcoinXT and will not support it and so with a blog post called The resolution of the Bitcoin experiment